Beauty and Personal Care rank among the most popular and fastest-growing eCommerce categories in Europe, with shopping trends evolving rapidly due to economic shifts, technological innovations, and changing consumer values. To remain competitive, brands must strategically leverage first-party consumer data and adopt agile eCommerce strategies like shoppable media.

The latest benchmarks from the MikMak Shopping Index offer valuable insights into the key drivers shaping Beauty and Personal Care eCommerce across Europe’s five largest markets: the UK, France, Germany, Spain, and Italy.

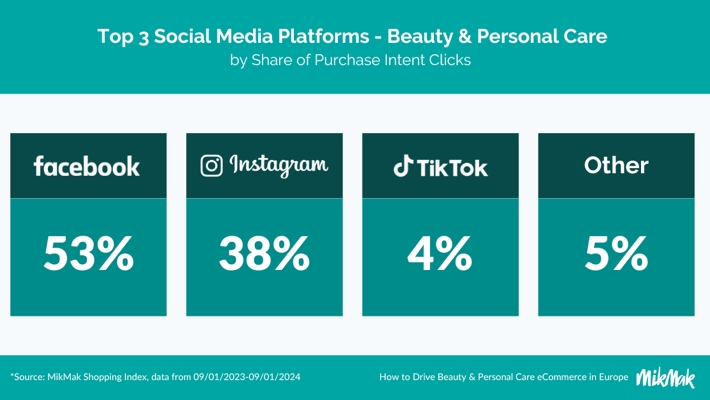

Meta leads but TikTok’s growth is shaking up Beauty and Personal Care social commerce

Meta platforms, Facebook and Instagram, currently lead the social commerce traffic for multichannel consumer brands on the MikMak platform via its shoppable media and where-to-buy solutions. However, TikTok is quickly increasing its impact.

In global analysis between 2023 and 2024, MikMak data showed a 10 percent growth in brand traffic on Meta, compared to a remarkable 190 percent increase on TikTok. Despite regulatory concerns, TikTok’s growth remains strong, particularly in the Beauty and Personal Care sectors, where user engagement is surging.

In Q3 2024, TikTok outpaced Meta in the UK and France among Beauty shoppers, based on Purchase Intent Clicks, a MikMak metric measuring in-market shopper traffic to retailers. Meanwhile, YouTube emerged as a significant player in Personal Care, in the top three ranking of the quarter.

As consumer preferences evolve due to factors like demographics, product categories, and platform features, brands must adapt their strategies to optimize performance across multiple social platforms.

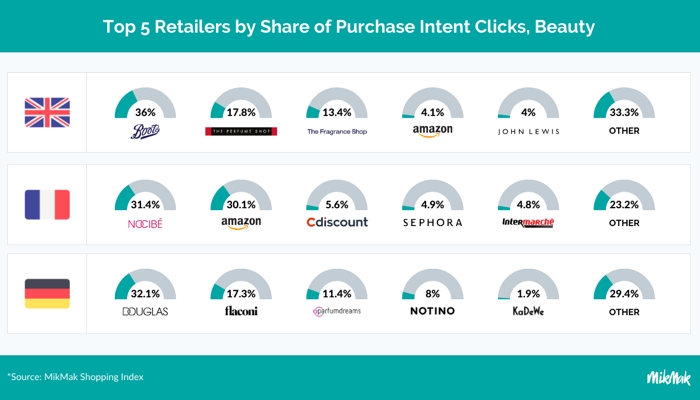

Amazon competes with specialized retailers for Beauty and Personal Care eCommerce traffic

Amazon continues to expand its presence in the Beauty and Personal Care sector. eMarketer attributes Amazon’s U.S. growth to strategic moves like expanding premium brand offerings and hosting exclusive Beauty sales events.

In Europe, Amazon has strengthened its position, especially in Personal Care. In France, Amazon also saw a 9-percentage-point increase in Beauty shopper traffic compared to last year, though it ceded the top spot to specialized retailer Nocibé, among the top five retailers.

Despite Amazon’s growing influence, specialized retailers such as Boots in the UK, Nocibé in France, and Douglas in Germany remain strong, commanding over a third of shopper traffic across Europe.

What to expect for Q4 and beyond

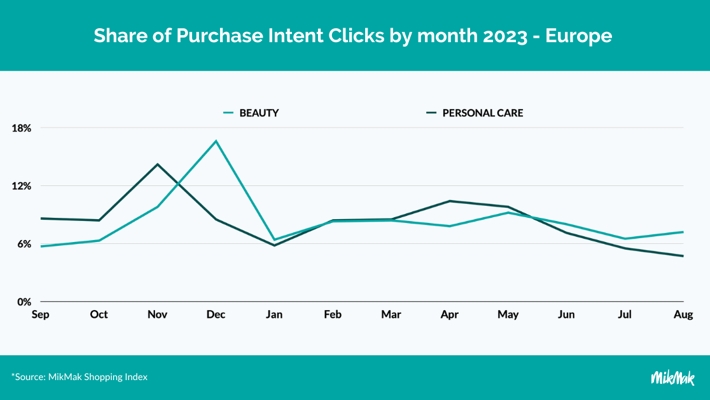

Q4 was the strongest period for Beauty and Personal Care brands in Europe in 2023, with Personal Care traffic peaking in November and Beauty sales highest in December. Online sales in these sectors are projected to grow by 10 percent, signaling another strong year ahead.

However, rising living costs are reshaping consumer behavior, so brands must closely track data and optimize marketing strategies to stay competitive and drive profitable eCommerce growth. Here are a few trends to watch:

– Premium vs Affordable

Shoppers are balancing premium product appeal with affordability, focusing on quality ingredients while hunting for discounts, rewards, and "dupes", affordable alternatives to luxury items. This trend is especially prevalent among Gen Z consumers.

– Gen Z & TikTok

Gen Z turns to TikTok first for discovering and evaluating brands, followed by Instagram, YouTube, and Facebook. With this group driving conversations on affordability and product research, brands must leverage these platforms to stay competitive.

– Fragrances and special beauty care

Fragrances lead Beauty shopper traffic in Europe, followed by concealers, foundations, and the rising popularity of makeup advent calendars. In Personal Care, cleansing gels and specialty dermocosmetics for skin and hair treatments are top performers, with items like anti-pigment serum showing high purchase intent.

– Shoppable media growth

We expect substantial growth in shoppable media advertising for Beauty and Personal Care brands across Europe in the coming year, fueled by rising digital ad spending and the increasing need for brands to optimize marketing profitability.

By effectively leveraging shoppable media and where-to-buy solutions, brands can streamline the shopping experience, making it easier for consumers to find and purchase from their preferred retailers. With advanced solutions such as MikMak, this approach will enable brands to maximize eCommerce opportunities and analyze marketing ROI through coherent and consistent first-party data collection across their digital media mix.

For more insights, best practices, and case studies, download MikMak’s latest guide, How to Drive Beauty & Personal Care eCommerce in Europe.